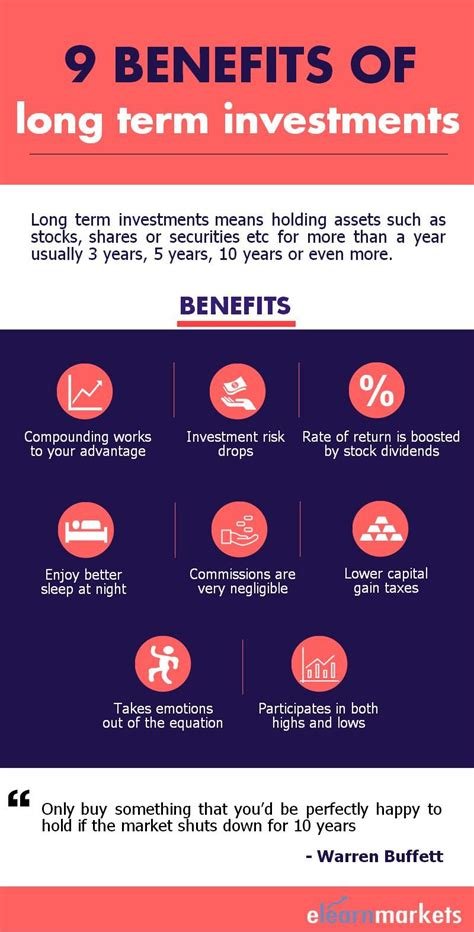

Long-term investing is essential for building a stable financial future, and this blogpost outlines The Benefits of adopting a disciplined approach to personal wealth. The article opens by exploring the concept of long-term investing for future growth, emphasizing the importance of strategic, patient capital deployment. Delving into modern investment trends, it highlights how diversified asset allocation significantly reduces risk while maximizing returns. With an analysis of market patterns and proven investment strategies, the text offers readers a comprehensive view of how smart planning can yield substantial benefits over time. A step-by-step guide to financial planning encourages both novice and seasoned investors to implement clear, actionable steps toward achieving financial goals. Moreover, by combining detailed analysis with practical advice, the post demonstrates how establishing a long-term strategy transforms market uncertainties into opportunities. Embracing The Benefits of long-term investing ultimately empowers individuals to secure their financial future efficiently, ensuring lasting financial prosperity.

Understanding Long-Term Investing For Future Growth

Long-term investing offers both strategic growth and stability, and by focusing on The Benefits of a well-planned portfolio, investors can better secure their financial futures. This approach minimizes the impact of short-term market volatility and creates a path for consistent wealth accumulation.

Adopting a long-term strategy means setting realistic goals and staying committed even during market fluctuations. Expert investors often stress that discipline, thorough research, and patience are key ingredients when targeting sustainable returns over time.

Key Points To Begin Your Journey

- Define clear financial objectives and time horizons.

- Conduct comprehensive market research before selecting assets.

- Diversify investments to mitigate risks.

- Monitor performance regularly without overreacting to short-term changes.

- Reinvest dividends and earnings to boost compound growth.

Many seasoned professionals affirm the value of long-term perspectives: Consistent commitment to a diversified portfolio not only builds wealth but also strengthens financial security against unforeseen market challenges. This rich insight reflects the importance of building resilient investment habits.

Ultimately, embracing a long-term strategy centered on The Benefits of deliberate planning and continuous learning can transform financial ambitions into lasting prosperity. With each measured decision, investors develop a robust framework capable of withstanding market uncertainties.

Exploring The Benefits In Modern Investment Trends

Long-term investing has emerged as a strategic approach that not only leverages the power of compounding but also builds resilient financial security, emphasizing The Benefits that modern trends bring to established strategies. This method of investment is increasingly recognized for its steady growth, risk mitigation, and capacity to foster sustainable wealth over time.

Investors adopting long-term perspectives benefit from a disciplined framework that prioritizes patience and gradual portfolio enhancement. By integrating market research with proven strategies, one can achieve compound growth and reduced exposure to market volatility. This approach helps investors maintain focus on sustained returns rather than reacting to every market fluctuation.

- Introductory Advantages And Considerations

- Clear emphasis on sustainable wealth accumulation

- Risk reduction through diverse asset allocation

- Enhanced benefits through compound interest

- Steady growth with market resilience

- Alignment with future financial goals

Market trends now favor strategies that incorporate both traditional and innovative investment methods, reinforcing the advantages of a long-term outlook. This balanced approach allows investors to navigate uncertain environments and benefit from evolving economic conditions while staying committed to core financial planning principles.

Overall, long-term investing is not merely a passive strategy but an active commitment to financial stability. By focusing on The Benefits of patience, disciplined reinvestment, and strategic diversification, investors can build a robust foundation for future success and achieve measurable progress toward financial security.

Analyzing Market Patterns And Investment Strategies

In the realm of long-term investing, understanding market dynamics is crucial for securing a robust financial future. Investors recognize that The Benefits of a well-planned investment strategy extend far beyond short-term gains, encompassing stability, growth, and resilience against economic shifts. This perspective is reinforced by meticulous research and data analysis that allows one to navigate the complexities of market cycles effectively.

- Stepwise Analysis Of Market Dynamics

- Identify key economic indicators

- Monitor market trends consistently

- Evaluate historical performance data

- Assess portfolio diversification

- Adjust strategies in response to market shifts

Before delving into deeper discussions, it is important to highlight the evolving nature of investment environments.

Market Trends

Current market trends reveal patterns that can provide both opportunities and challenges; investors who stay informed about industry shifts, regulatory changes, and global events are better prepared to make decisions that optimize their risk and return balance.

Building on the analysis of observable trends, another critical aspect is understanding and mitigating risks.

Risk Assessment

An effective risk assessment framework not only examines potential downsides but also identifies opportunities for strategic adjustments. As one investor aptly noted in a reflective analysis, A proactive approach to risk not only preserves capital but also opens avenues for growth during market downturns. This mindset is essential for maintaining long-term financial security and adapting to unforeseen market disruptions.

Step-By-Step Guide To Financial Planning

Effective financial planning lays the foundation for securing a thriving future, where The Benefits of long-term investing offer a strategic approach to building wealth over time. Careful planning and disciplined investment habits empower individuals to weather market fluctuations and prepare for uncertain economic climates while taking advantage of growth opportunities.

Sequential Steps For Effective Planning

- Assess your current financial status.

- Set realistic short-term and long-term goals.

- Create a detailed budget plan.

- Identify potential investment opportunities.

- Monitor and adjust your strategy regularly.

A structured approach not only simplifies decision-making but also supports consistent progress towards financial stability; Commitment to performance-driven strategies transforms complex financial landscapes into manageable steps toward success. This methodical process ensures that every action taken is aligned with overall objectives, reflecting a blend of prudence and ambition.

As individuals move forward, the integration of risk management techniques and regular review sessions enables a deeper understanding of market dynamics, reinforcing the importance of balance and diversification in every portfolio. Meticulous review and adaptive strategies underline the resilience of a well-planned financial future.

Budget Analysis

An in-depth budget analysis is essential for identifying spending patterns and uncovering potential savings, ensuring that every dollar is optimally allocated. This process not only highlights areas for improvement but also supports the formulation of effective strategies that align with both immediate needs and long-term financial ambitions.

Investment Optimization

Focusing on investment optimization allows individuals to maximize returns while managing associated risks. By continuously refining their investment mix, investors are better positioned to respond to market trends and harness opportunities that drive sustainable wealth accumulation.

Building Financial Security Through Diversified Asset Allocation

Long-term investing offers The Benefits that many individuals seek as a pathway to financial security, and a diversified asset allocation strategy plays a key role in mitigating risk while opening avenues for growth.

- Critical Factors For Robust Portfolios

- Comprehensive Risk Assessment

- Strategic Asset Allocation

- Periodic Portfolio Rebalancing

- Long-Term Market Perspective

- Consistent Investment Contributions

Allocating investments across multiple asset classes not only helps in reducing volatility but also ensures that no single market downturn can overly impact your overall portfolio performance.

Investors who maintain an extended time horizon benefit from compounded gains and a smoothing effect over market cycles, as illustrated by the rich insight: Investing is a marathon, not a sprint. This approach calls for a disciplined mindset and steady commitment to one’s financial plan.

Embracing detailed strategies in asset allocation requires a thoughtful review of current holdings and future objectives, ensuring that each element of your portfolio is aligned with long-term goals before diving into more specialized tactics.

A focused outlook on tailored investment approaches sets the stage for exploring specific methodologies further.

Asset Diversification

By spreading investments across varied sectors and asset classes, investors can significantly lower risks associated with market volatility while capitalizing on growth opportunities; this critical practice is essential for building a resilient portfolio that evolves with economic trends.

Preparing for future market shifts involves periodic review and recalibration, which fosters a balanced and diversified investment approach.

Careful attention to market signals and adjustments is a key precursor to successful portfolio optimization.

Portfolio Management

An effective portfolio management strategy revolves around continuous monitoring, rebalancing, and a forward-thinking investment philosophy that underscores how The Benefits of long-term strategies can yield substantial rewards over time.

Finalizing Investment Strategies With Clear Actionable Steps

Finalizing your investment strategies is a critical step in ensuring financial security, and leveraging The Benefits of long-term investing can be pivotal in creating a resilient portfolio. Strategic clarity, consistency, and a focus on actionable outcomes lay the groundwork for a sustainable financial future that adapts to market shifts and evolving personal goals.

Actionable Steps For Immediate Investment Improvement

- Evaluate your current portfolio performance and risk exposure.

- Set clear, measurable, and realistic financial objectives.

- Diversify investments across multiple asset classes to reduce risk.

- Consistently review and adjust your strategy based on market trends.

- Consult with professional advisors to refine and validate your approach.

A well-defined strategy not only boosts investor confidence but also serves as a compass for navigating volatile market conditions. “A disciplined approach to investment planning, backed by regular reviews and adjustments, is essential for long-term financial security.” Emphasizing actionable steps ensures that each decision taken contributes directly to your overarching financial goals.

By integrating these targeted measures, investors can fine-tune their portfolios to respond effectively to market dynamics while maintaining a focus on sustained growth. The clear, methodical strategy reinforces the idea that every small improvement is an investment in a more secure and prosperous future.

Frequently Asked Questions

What distinguishes long-term investing from short-term trading strategies?

Long-term investing focuses on holding assets over extended periods, allowing investors to benefit from compounding returns and to ride out market volatility, whereas short-term trading typically involves frequent buying and selling based on market fluctuations.

How does long-term investing contribute to building financial security?

By emphasizing steady growth and diversified asset allocation, long-term investing helps smooth out short-term market fluctuations, enhances compounding, and supports consistent wealth accumulation, ultimately leading to improved financial security.

What market trends support the case for adopting long-term investment strategies?

Modern market trends such as technological advancements, globalization, and evolving economic policies underscore the value of long-term investments, as they allow investors to capture growth over time and adapt to changes in market patterns.

How important is diversification in a long-term investing strategy?

Diversification is crucial because it spreads risk across various asset classes, reducing the impact of a downturn in any single market segment while taking advantage of different growth opportunities in the long run.

What factors should be considered when developing a long-term investment plan?

Key factors include your financial goals, risk tolerance, market research, consistent evaluation of market trends, and a disciplined approach to asset allocation and rebalancing over time.

How can a consistent long-term investment approach help overcome market volatility?

A disciplined, long-term strategy allows investors to remain focused on fundamental value and gradual growth, enabling them to weather short-term market downturns and benefit from subsequent recoveries.

What role does market analysis play in refining long-term investment strategies?

Comprehensive market analysis helps identify underlying trends and patterns, allowing investors to adjust their asset allocation and investment strategies, thereby enhancing their ability to achieve sustainable growth over time.

What actionable steps can beginners take to start long-term investing?

Beginners should start by setting clear financial goals, researching and selecting a diversified set of investments, creating a detailed financial plan, and consistently reviewing and adjusting their portfolio to maintain alignment with their long-term objectives.

Leave a Reply