The article ‘Building Wealth Through Smart Investing: A Comprehensive Guide’ presents a strategic roadmap for those aiming at building wealth through disciplined investment practices. It lays out the foundations of smart investing by emphasizing the importance of understanding market fundamentals and assessing personal risk tolerance. The guide further explores building wealth through strategic planning, providing insights on analyzing market trends and risks to create a resilient investment portfolio. It also discusses the importance of diversifying investment strategies for growth and implementing effective tax optimization techniques to maximize returns. With actionable next steps for smart investing, the article equips readers with practical tips to navigate the complexities of modern financial markets confidently. This comprehensive approach ensures that both new and seasoned investors can enhance their portfolios, reduce potential risks, and steadily progress towards long-term financial security and freedom. Ultimately, the guide inspires confidence and motivates proactive actions for lasting financial success.

Foundations Of Smart Investing

The journey towards Building Wealth begins with a robust understanding of risk, reward, and market dynamics; by laying a solid foundation, investors empower themselves with the knowledge needed for making informed decisions, as illustrated by comprehensive research and real-life success stories that underscore the importance of a disciplined investment approach.

Establishing clear financial objectives and a tailored strategy is essential for smart investing; investors who align their goals with market opportunities create a pathway that not only preserves capital but also paves the way for growth through thoughtful diversification and regular monitoring of performance metrics.

- Key Introduction Points

- Understand your risk tolerance and financial capacity

- Set clear, achievable financial goals

- Diversify your investment portfolio effectively

- Analyze market trends and economic indicators

- Monitor and review your investment performance

Embracing a methodical approach to investing, market analysis, and risk management allows individuals to tailor their strategies uniquely; this adaptability is critical in responding to evolving market conditions, ensuring sustained progress towards long-term objectives and the realization of Building Wealth.

By continuously refining investment techniques and staying informed about market shifts, investors can transform volatile opportunities into stable gains, ultimately reinforcing the importance of perseverance, strategic planning, and a well-rounded portfolio in the realm of smart investing.

Building Wealth Through Strategic Planning

The journey towards Building Wealth is paved with thorough strategic planning and actionable insights. Smart investing requires not just capital but a well-considered blueprint that integrates market research, risk management, and long-term vision to navigate complex financial landscapes effectively.

Essential Planning Elements

- Establish clear financial goals

- Conduct comprehensive market analysis

- Develop diversified investment portfolios

- Implement risk management strategies

- Monitor investment performance regularly

A thoughtful plan in smart investing can transform challenges into opportunities, as illustrated by the following insight: A clear strategy and continuous adaptability are the cornerstones of creating sustainable wealth. Recognizing these perspectives ensures that each decision contributes to overall prosperity and remains aligned with broader investment objectives.

With a commitment to regular assessment and continuous learning, investors can refine their strategic approach over time. By integrating these principles with a responsive mindset, one significantly increases the potential for maximizing returns while mitigating unforeseen setbacks in an ever-changing economic environment.

Analyzing Market Trends And Risks

The current economic climate demands a thorough evaluation of market behavior to ensure that Building Wealth remains sustainable. In today’s dynamic financial environment, carefully examining evolving trends and integrating expert advice becomes essential. An informed investor is a successful investor—knowledge is the stepping stone to financial growth. This perspective emphasizes that proactive trend analysis is pivotal for a robust investment strategy.

Steps To Analyze Trends

- Review historical data to identify recurring patterns.

- Analyze current market signals for early warning signs.

- Assess economic indicators that influence market dynamics.

- Monitor geopolitical events that may trigger market shifts.

- Integrate expert forecasts to refine your strategy.

Before diving into specialized areas, it is important to lay a solid foundation by understanding both market momentum and inherent risks. A systematic approach that combines data-driven insights with experienced judgment helps in making informed decisions that drive Building Wealth over time.

Trend Analysis

This segment illuminates the process of trend analysis, where investors evaluate historical performance, seasonal factors, and long-term growth patterns. By concentrating on clear market signals and employing comprehensive analytics, investors can identify opportunities and position themselves advantageously.

Risk Assessment

Effective risk assessment is a critical complement to trend analysis. It involves rigorous review of potential market volatilities, liquidity challenges, and external economic pressures. Balancing opportunity with caution ensures that strategies aimed at Building Wealth maintain resilience even amidst unexpected downturns.

Diversifying Investment Strategies For Growth

The journey toward Building Wealth in today’s dynamic markets requires a balanced approach that blends traditional methods with innovative diversification techniques. By integrating time-tested strategies and new opportunities, investors can create a resilient portfolio designed to weather market fluctuations. A thoughtful blend of assets is essential for sustainable growth and risk management.

In developing a robust investment strategy, it is important to continually assess asset performance and market trends. Many investors are turning to modern metrics and data-driven insights to guide their decisions, ensuring their asset mix is both adaptive and forward-looking. Expert insights suggest that a diversified portfolio is not only about spreading risks but also about capitalizing on emerging opportunities.

- Actionable Diversification Steps

- Conduct a comprehensive review of current assets.

- Establish clear investment goals and risk tolerance.

- Integrate alternative investment channels.

- Monitor market trends and rebalance regularly.

- Utilize expert advice to refine the strategy over time.

Adopting diversified investment strategies is not a one-time process; it involves continuous learning and adjustment as the market evolves. Investors who stay proactive and informed can better navigate economic cycles and regulatory changes, aligning their portfolios with both long-term goals and short-term opportunities.

Ultimately, a well-diversified portfolio not only safeguards assets during turbulent times but also paves the way for sustainable growth. Implementing these practices empowers investors to maintain balance, remain agile, and steadily progress toward their financial objectives while keeping focused on Building Wealth.

This section further delves into specific strategies that complement the broader diversification approach.

Asset Allocation

A careful evaluation of how funds are distributed among various asset classes is critical. Optimal asset allocation enables investors to capture market gains while mitigating potential downsides, making it a foundational component of any wealth-building strategy.

Before exploring another element of a dynamic investment strategy, it is vital to consider the methods that help adapt a portfolio to shifting market conditions.

Portfolio Rebalancing

Regular rebalancing of a portfolio ensures that it remains aligned with an investor’s risk tolerance and financial goals. This process involves adjusting the weights of various asset classes to avoid overexposure in any one area, thereby promoting stability and long-term growth.

As global markets continue to evolve, emerging opportunities offer unique prospects for savvy investors.

Emerging Markets

Investing in emerging markets can provide significant growth potential due to rapid economic development and expanding consumer bases. With thorough research and strategic planning, these markets offer promising avenues to enhance portfolio diversification and overall returns.

Implementing Effective Tax Optimization Techniques

Smart tax planning plays a crucial role in Building Wealth as it allows investors to keep more of their earnings while reinvesting savings into their portfolios. Effective tax optimization not only reduces liabilities but also sets the foundation for long-term financial growth.

In today’s dynamic financial landscape, understanding various tax avenues can transform investment strategies. Smart tax optimization can lead to significant savings over time, providing extra capital for reinvestment. With targeted analysis and strategic measures, investors can harness tax benefits to fuel their wealth-building journey.

- Tax Saving Steps

- Review all income sources to understand taxable components.

- Maximize contributions to retirement accounts for tax advantages.

- Leverage available deductions and credits to lower tax bills.

- Invest in tax-efficient funds to minimize capital gains taxes.

- Consult a tax professional for personalized strategies.

Tax Strategies

Implementing tailored tax strategies involves assessing both current and future financial scenarios, ensuring that every decision contributes to a robust tax profile and sustainable wealth accumulation.

By integrating effective tax planning with overall investment tactics, investors create a resilient framework that not only reduces costs but also paves the way for consistent, long-term financial success.

Actionable Next Steps For Smart Investing

Smart investing is not about making impulsive decisions, it is a disciplined approach designed to create Building Wealth over time. Emphasizing strategic planning and thorough market research, this approach builds on previous insights and data while integrating advanced methods to manage investments effectively.

Practical Next Steps

- Conduct a comprehensive review of your current investment portfolio.

- Define clear financial goals and investment timelines.

- Research emerging market trends and evaluate risk-adjusted returns.

- Diversify your assets to reduce volatility and enhance stability.

- Regularly monitor performance and adjust your strategies accordingly.

When considering these steps, it is crucial to remain focused on long-term outcomes and avoid reacting to short-term market fluctuations. As one expert noted, A well-planned investment strategy is the cornerstone of sustained financial growth. This perspective reinforces the value of disciplined, informed decision-making.

The outlined steps serve as a practical roadmap, merging analytical insight with actionable tactics. Investors who blend solid research with clear strategic objectives often find themselves better prepared to navigate market uncertainties and capitalize on opportunities.

Ultimately, integrating these next steps into your financial strategy can lead to significant advantages. Tailoring your approach based on personal goals and market conditions is essential for maintaining a resilient investment portfolio in an ever-evolving economic landscape.

Frequently Asked Questions

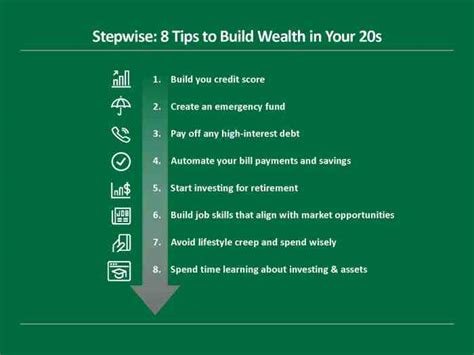

What initial steps should I take when starting to build wealth through smart investing?

Begin by establishing a solid financial foundation, which includes creating a budget, setting clear financial goals, and understanding your risk tolerance. Educate yourself on basic investment principles and research different asset classes before diving into any specific investment vehicle.

How does long-term strategic planning impact investment outcomes?

Long-term strategic planning helps you align your investments with your personal financial goals. By setting clear objectives and timelines, you can choose strategies that withstand market fluctuations, enable gradual wealth accumulation, and reduce the influence of short-term market volatility on your portfolio.

In what ways can analyzing market trends enhance my investment strategy?

Regular market analysis allows you to identify emerging opportunities and potential risks early on. Staying informed about economic indicators, sector performance, and geopolitical events can help you adjust your portfolio proactively and make informed decisions that maximize your chances of building wealth.

What are the benefits of diversifying my investment portfolio?

Diversification helps mitigate risks by spreading your investments across different asset classes, industries, and geographical regions. This strategy reduces the impact of a downturn in any single investment, ensuring a more stable growth path and contributing to long-term wealth building.

How can I identify and manage risks inherent in smart investing?

Risk management begins with understanding the specific risks associated with each type of investment. Conduct thorough research, stay educated on market conditions, and consider using tools like stop-loss orders. Additionally, consult financial advisors and periodically review your portfolio to balance risk and reward effectively.

What are some effective tax optimization strategies that can boost my investment returns?

Tax optimization strategies such as investing in tax-efficient funds, utilizing retirement accounts like IRAs or 401(k)s, and employing strategic asset location can help you minimize taxable events. Understanding the tax implications of each investment and timing your transactions can also enhance your overall return on investment.

What practical steps can beginners take to start their wealth-building journey?

Beginners should start by educating themselves about investment basics and setting clear financial goals. It is important to create an emergency fund, build a diversified portfolio, and consider low-cost index funds or exchange-traded funds (ETFs) as starting points. Seeking guidance from financial professionals can also provide a tailored strategy to meet your individual needs.

How do I transition from seeking short-term gains to focusing on long-term wealth accumulation?

Transitioning to long-term wealth accumulation involves shifting your mindset from immediate returns to sustainable growth. Evaluate your investments based on long-term potential rather than short-term market movements, reinvest dividends, and continuously review your strategy to ensure it aligns with your evolving financial goals. Patience and consistency are key in this process.